Step Costs Strategic Cost Management Vocab, Definition, Explanations Fiveable

In each of the examples, managers are able to trace the cost of the materials directly to a specific unit (cake, car, or chair) produced. Since the amount of direct materials required will change based on the number of units produced, direct materials are almost always classified as a variable cost. They remain fixed per unit of production but change in total based on the level of activity within the business. Many businesses can make decisions by dividing their costs into fixed and variable costs, but there are some business decisions that require grouping costs differently. Sometimes companies need to consider how those costs are reported in the financial statements. At other times, companies group costs based on functions within the business.

Trending in Accounting

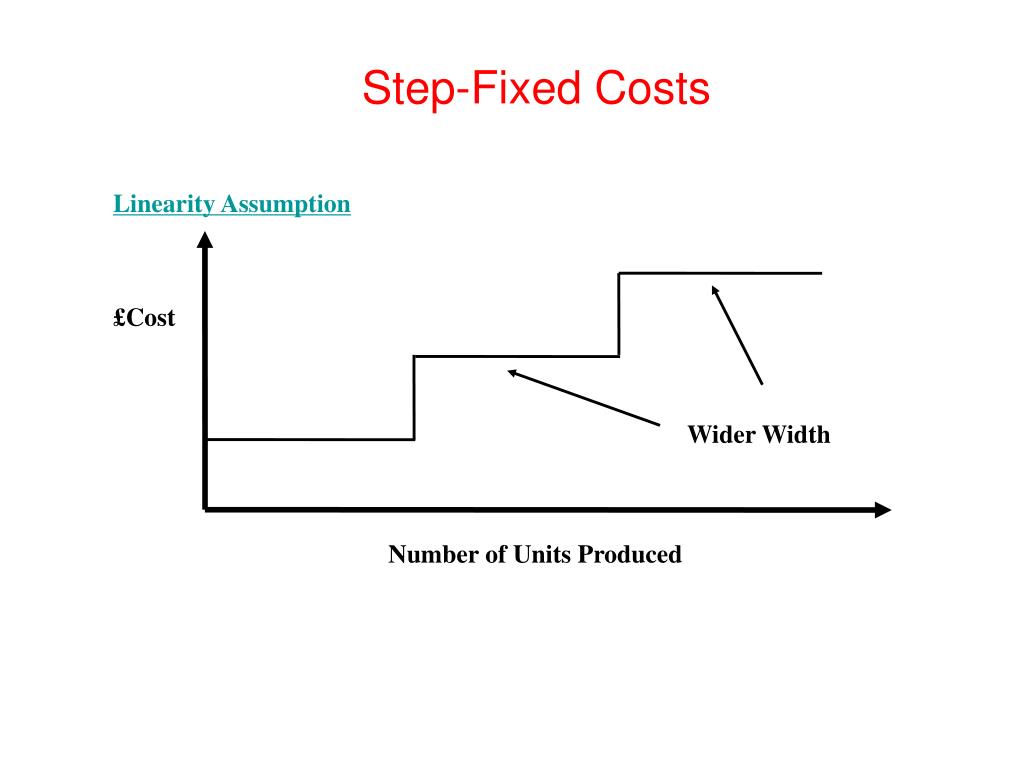

For example, a manufacturer will want to know how its costs will increase if a new product line is added (or how costs could decrease if an existing product line is eliminated). One shop floor supervisor has daily capacity limits above 2,000 units whereby two shop floor supervisors have daily capacity limits up to 4,000 units. When accountants prepare financial statements of past performance, they use a variety of categories for recording costs.

Effects of Changes in Activity Level on Unit Costs and Total Costs

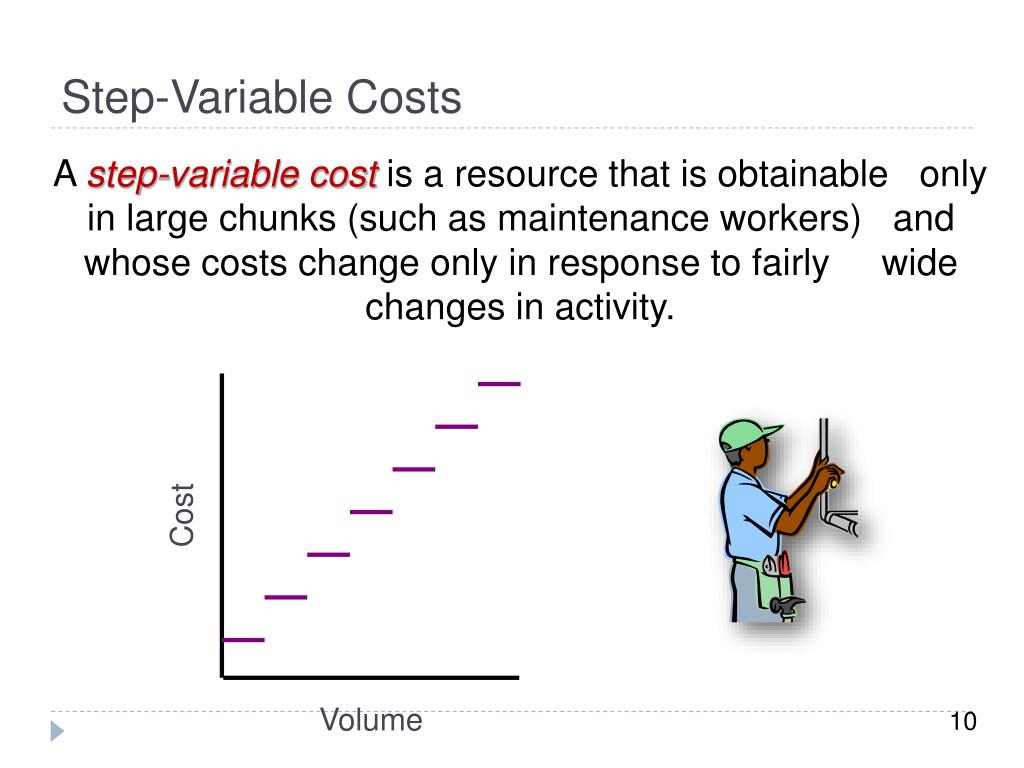

Unlike fixed costs that remain fixed in total but change on a per-unit basis, variable costs remain the same per unit, but change in total relative to the level of activity in the business. Revisiting Tony’s T-Shirts, Figure 6.26 shows how the variable cost of ink behaves as the level of activity changes. Step costs are expenses that are constant for a given level of activity, but increase or decrease once a threshold is crossed. Step costs change disproportionately when production levels of a manufacturer, or activity levels of any enterprise, increase or decrease. When depicted on a graph, these types of expenses will be represented by a stair-step pattern. It is important to remember that even though Tony’s costs stepped up when he exceeded his original capacity (relevant range), the behavior of the costs did not change.

Graphical presentation of cost behavior

The advantage to handling the increased cost in this way is that when demand falls, the cost can quickly be “stepped down” again. Because these types of step costs can be adjusted quickly and often, they are often still treated as variable costs for planning purposes. Mixed costs are those that have both a fixed and variable component. It is important, however, to be able to separate mixed costs into their fixed and variable components because, typically, in the short run, we can only change variable costs but not most fixed costs. To examine how these mixed costs actually work, consider the Ocean Breeze hotel. We have established that fixed costs do not change in total as the level of activity changes, but what about fixed costs on a per-unit basis?

- If you make 25,000 pencils your cost triples because you need three employees.

- For a step cost to occur, the workload must either increase or fall below a certain threshold level.

- It is important to note that manufacturing overhead does not include any of the selling or administrative functions of a business.

- For example, purchasing $2,000 worth of erasers to use in making pencils (above) is a sunk cost.

Step costs are best explained in the context of a business experiencing increases in activity beyond the relevant range. A step cost is also known as a stepped cost or a step-variable cost. If the shop receives anywhere from zero to 30 customers per hour, it will only need to pay the cost of having one employee, say $50 ($20 for the employee, $30 for all other expenses, fixed and operating).

Step Costs

What happens to the AFC if they increase or decrease the number of boats produced? Remember that the reason that organizations take the time and effort to classify costs as either fixed or variable is to be able to control costs. When they classify costs properly, managers can use cost data to make decisions and plan for the future of the business.

Variable costs are those costs that vary directly with the amount of production. For example, if you are a pencil maker, you need an eraser holiday season for each pencil you make. If erasers cost 20 cents each, the variable eraser cost of making 1,000 pencils is $200 (1,000 X $.20).

Committed fixed costs are fixed costs that typically cannot be eliminated if the company is going to continue to function. An example would be the lease of factory equipment for a production company. These costs are variable in the sense that they can change with the level of activity, but they do so in “steps” rather than in a continuous linear manner. Costs that do not change with the level of production or sales within a relevant range. If you look at your business finances, you’ll discover that many of your expenses are examples of step costs.

Leave a Reply